Algorithmic trading, or algo trading, uses computer programs to execute high-frequency trades based on predefined criteria, such as price, volume, or technical indicators.

Algorithmic trading, often referred to as algo trading, is a method of executing orders in financial markets using automated and pre-programmed trading instructions. Here are some key points about algo trading:

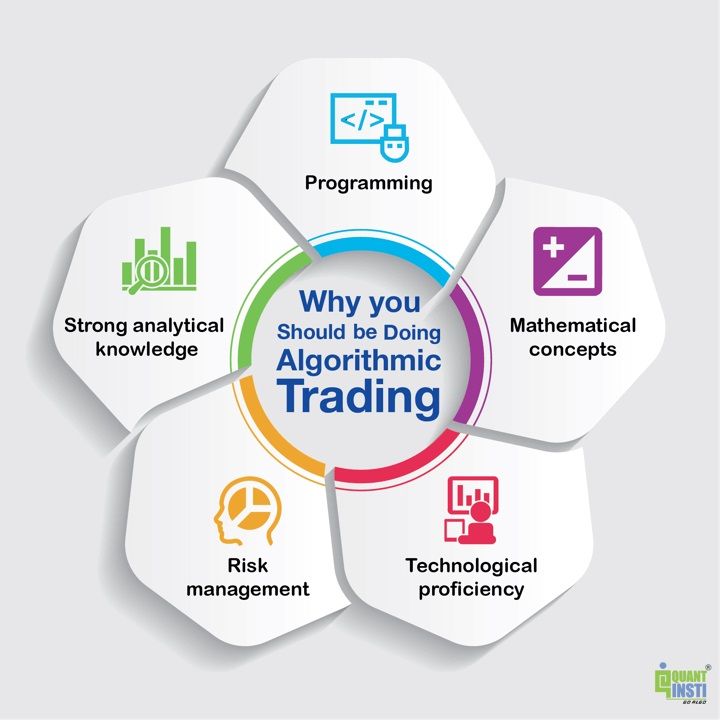

1. **Automation**: Algo trading relies on computer programs or algorithms to execute trades. These algorithms can be designed to make decisions based on various criteria, such as price, volume, time, or other market data.

2. **Speed**: One of the primary advantages of algo trading is its ability to execute orders with extremely high speed. This can be crucial in markets where prices can change rapidly.

3. **Strategies**: Traders can implement a wide range of strategies in algo trading. These can include trend-following, mean-reversion, statistical arbitrage, and more. The choice of strategy depends on the trader’s goals and risk tolerance.

4. **Risk Management**: Algo trading systems can incorporate risk management rules to control the size of positions, set stop-loss orders, and manage overall exposure to the market.

5. **Backtesting**: Before deploying an algorithm in live trading, it’s common to backtest it using historical data to evaluate its performance. This helps refine the strategy and assess its potential profitability.

6. **Market Access**: Algo trading often requires direct market access (DMA) to execute orders without manual intervention. This means the algorithms can connect directly to exchanges or other trading venues.

7. **Liquidity**: Algo trading can contribute to market liquidity by providing continuous buying and selling activity.

8. **Regulation**: Algo trading is subject to regulation, and there are rules and safeguards in place to prevent market manipulation and ensure fair and orderly trading.

9. **High-Frequency Trading (HFT)**: Some algo trading strategies, known as high-frequency trading, aim to profit from small price differences within very short timeframes. HFT is known for its extreme speed and can be controversial.

10. **Technical and Quantitative Analysis**: Algo trading often relies on technical and quantitative analysis to identify trading opportunities and make decisions.

Algo trading has become increasingly popular in financial markets, used by institutional investors, hedge funds, and even some individual traders. It offers the potential for efficiency, precision, and the ability to execute complex strategies automatically. However, it also comes with risks, including the need for robust technology infrastructure and the potential for unexpected market events to disrupt trading strategies.